I have published three ideas to this substack. I thought it would be useful to update performance on each of these posts and some thoughts following earnings.

TLYS has underperformed the S&P 500 by 11% since I posted the idea May 1st. In the period since I posted the idea, recession fears intensified and small cap apparel retailers like TLYS broadly underperformed the market. TLYS actually outperformed the apparel peer group I track by 8% (ZUMZ, ANF, AEO, BKE, GPS, EXPR, URBN, GES, RL) and has outperformed the list of retail comps I laid out in the original post by 4%.

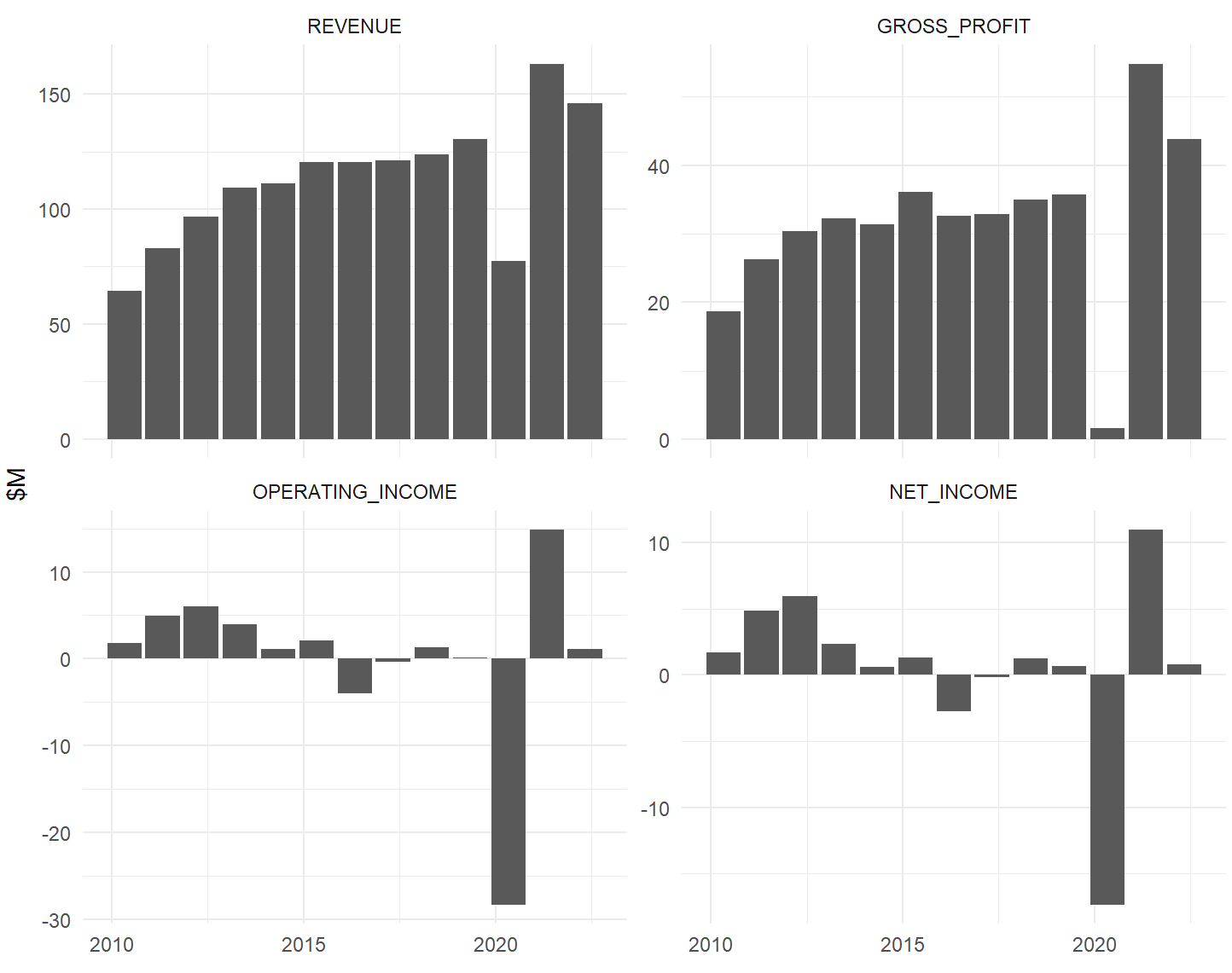

On June 2nd TLYS reported Q1 earnings. Here is a chart comparing the most recent quarter results with previous Q1 results:

So revenue and gross profit handedly beat pre-pandemic numbers but operating income and net income came in similarly to pre-pandemic numbers. Management attributed the decline in operating margin to wage inflation. My expectation is merely that TLYS returns to pre-COVID numbers so the Q1 result is inline with the investment thesis I laid out. The company’s operating income guide for Q2 was 28% above the average Q2 operating income in the 5yrs proceeding the pandemic, a supportive development for the thesis.

The company guided capital expenditure for FY2023 (which runs through Jan 2023) to $24M which is about $10M above the run-rate pre-pandemic. This is a negative development, as it will crimp FCF this year from my expectation of $20M to more like $10M. I would prefer to see cash return via reinvestments than expansion given the long-run fickle nature of apparel retail, but it doesn’t wreck the thesis so long as the company doesn’t go back into full-blown expansion mode.

In the short-term, I expect TLYS to continue to trade with the “recession-on, recession-off” factor. Outperformance will come one of two ways. Either recession fears decline and results stabilize to pre-COVID levels, or we endure a recession and results are comparable to pre-covid levels as we come out the other side.

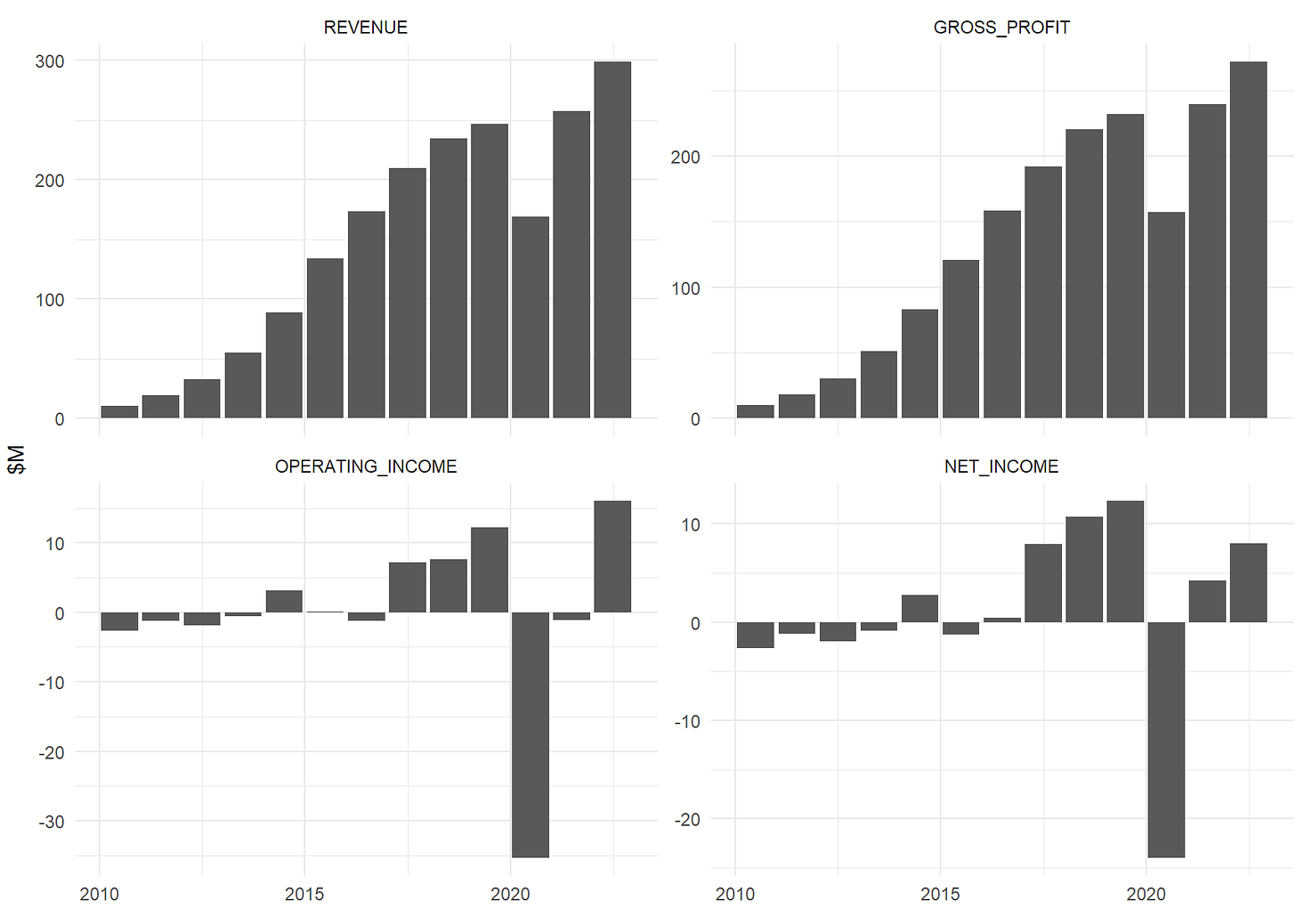

This one has outperformed so far - outpacing the S&P 500 by 22% since my writeup on 5/30 following Q2 results. The Q2 numbers proved that YELP has returned to its pre-covid growth trajectory, with a little more flow-through to the bottom line as the company picks up a bit of operating leverage on R&D:

One interesting takeaway from earnings was that home services ad revenue was up 14% y/y despite consumer demand clearly pivoting away from home services. Last year, demand was so overwhelming that home service providers simply did not need to advertise to fill out their schedules. This year they do.

Another interesting line from the letter to shareholders:

“We may also opportunistically increase our investment in consumer performance marketing in the third quarter to drive app installs at attractive costs while better leveraging push notifications and email campaigns to re-engage existing users on both Android and iOS.”

As Yelp dramatically increases the value of each click through ad-tech R&D, at some point it becomes accretive to direct investment dollars towards acquiring more clicks. It seems like management has reached that point. I wonder if a push towards generating more cultural awareness about Yelp might have the side effect of improving investor perception of the brand. We will see.

Short AAPL - Apple

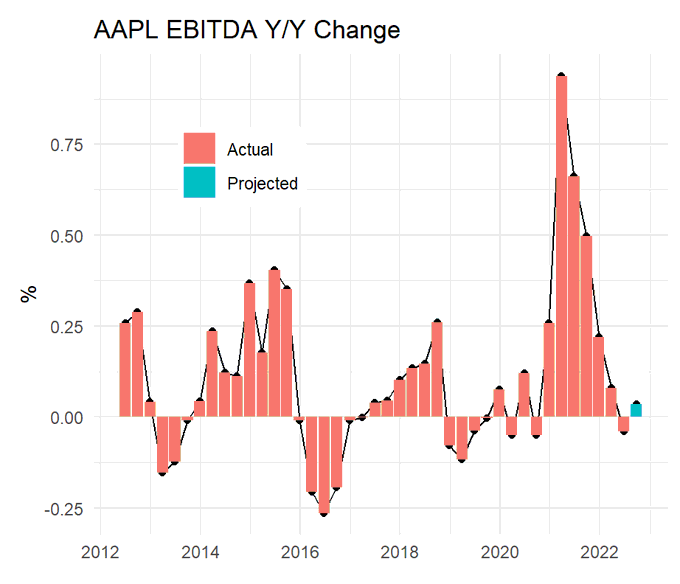

This trade has had a rough start. Since I published this on June 24th, AAPL has outpaced the S&P 500 by 12%. Q2 earnings were in line with my and market expectations, continuing the trend of deceleration, but management seemed to imply that the trend will reverse next quarter. Here is Y/Y EBITDA with consensus estimates for next Q:

So the moment of reckoning for my thesis seems set to come at the next earnings release. If EBITDA does manage to buck the trend, cementing the pandemic surge in earnings power as permanent, my thesis will be broken and I will have to materially reduce the position at a minimum. I just can’t believe this thing is trading at 27x trailing FCF (ex SBC) with the pivot we are seeing in consumer spending away from goods, particularly away from electronics.

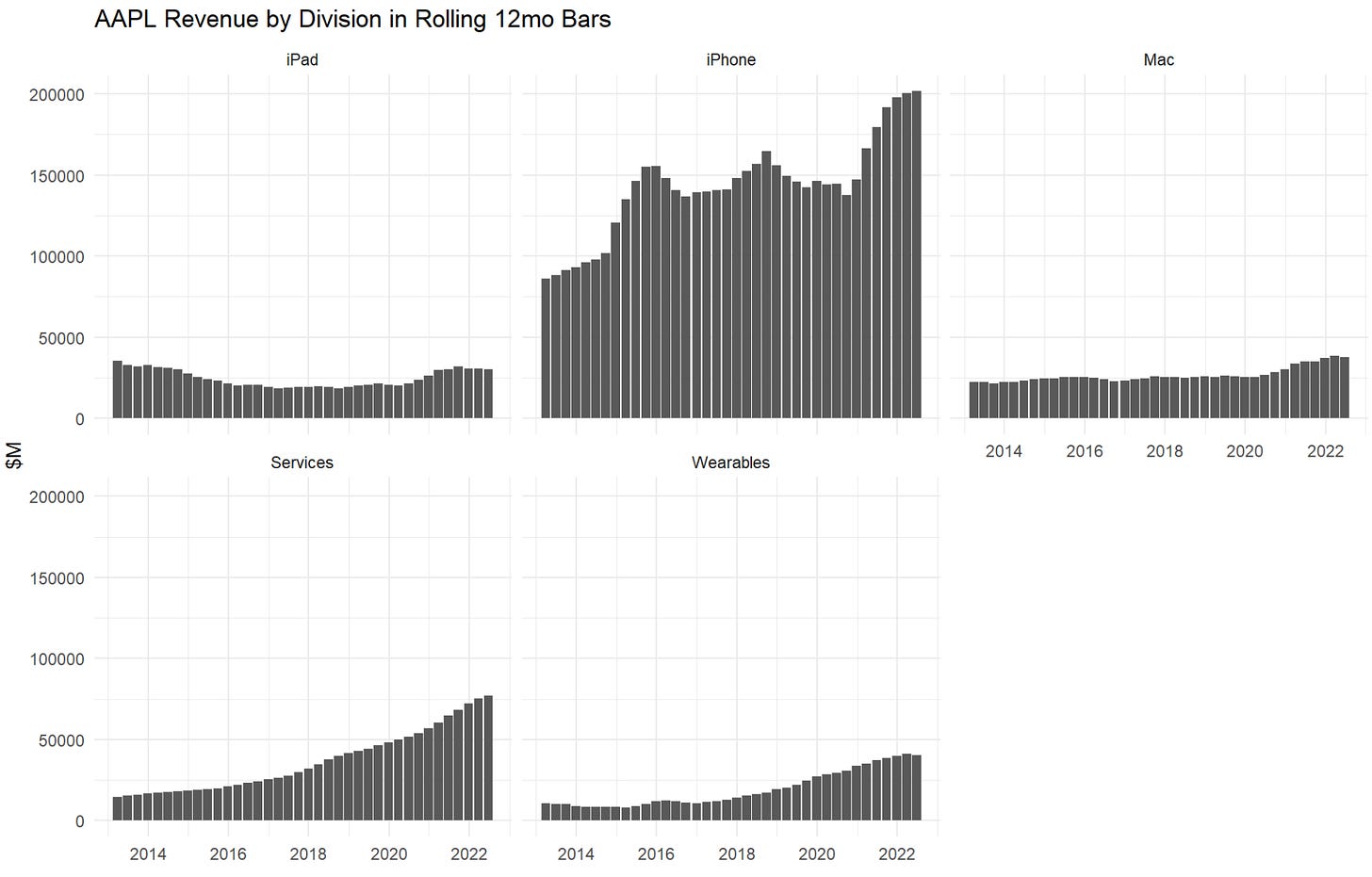

Here is updated revenue by division:

Will iPhone really hold all these gains after being stagnant for so long?