Urban Outfitters - $URBN

I will assume readers are familiar with URBN’s basic business. For a description, see the “Part 1” section of the URBN 10-k here.

Summary

$URBN is an apparel retailer priced at 8.5x pre-pandemic FCF (net of cash). URBN has several favorable attributes which make this multiple too low. First, I estimate almost half of URBN’s EV is covered by its significant real estate portfolio. Second, URBN’s brand mix is transitioning favorably as the core Urban Outfitter’s (UO) brand loses share to the faster growing Free People (FP) brand. In addition to being faster growing, the Anthro and FP brands cater to a higher income customer, which buffers cyclicality to some degree. Finally, the nascent Free People “Movement” and Nuuly brands offer optionality.

The company faces two headwinds to FCF generation in the near-term. First, the apparel industry at large is suffering a hangover following record 2021 results - URBN is not immune to this backdrop. Second, URBN is investing in a fulfillment center to support its ecommerce growth, and this investment is absorbing a lot of FCF. I will make the case that both these issues are transitory and will clear in time, leading to FCF normalization and multiple expansion.

FCF History and CapEx

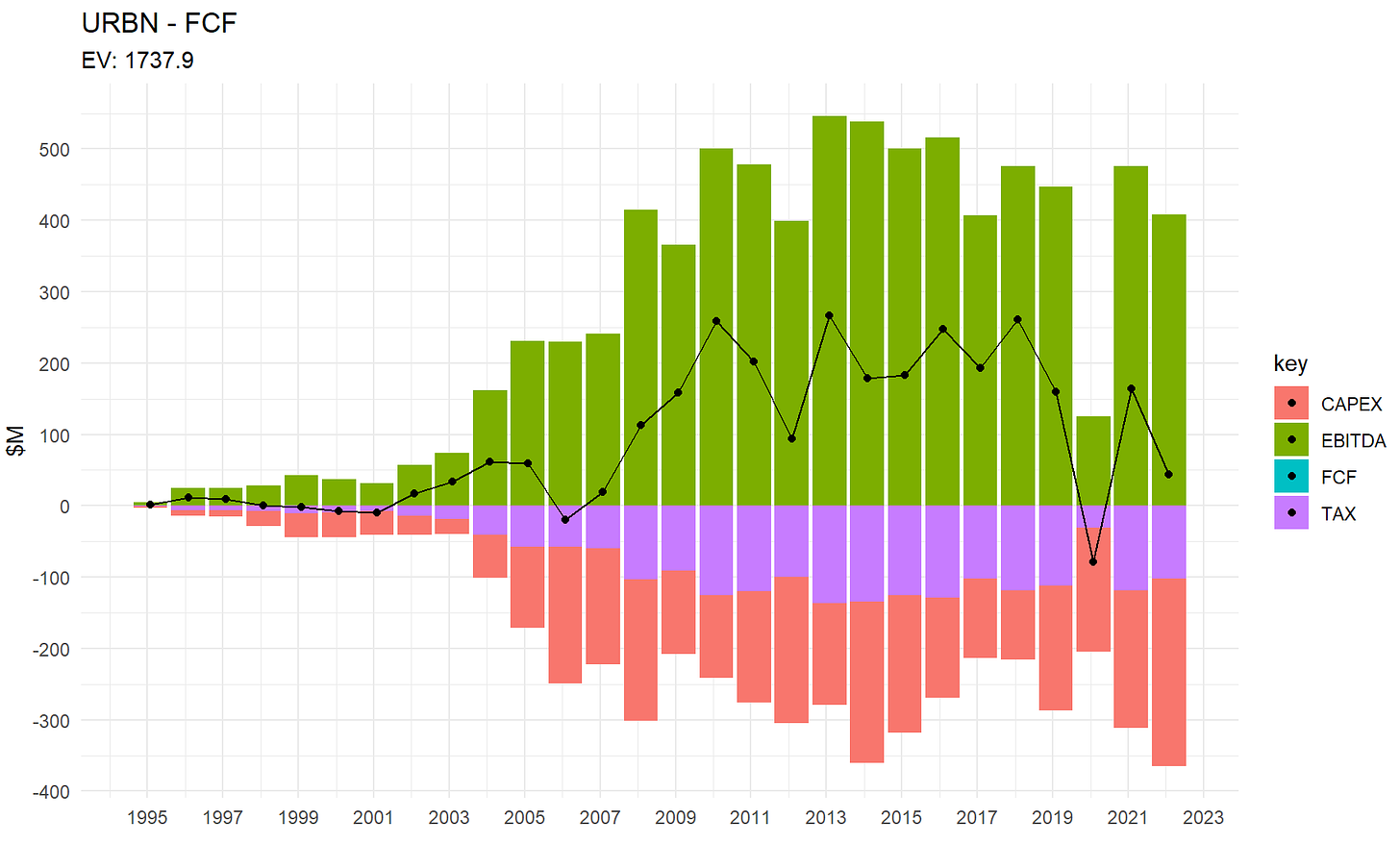

Below I chart EBITDA, capex and an assumed tax rate (25% EBITDA) and combine to get a smoothed FCF figure (the black line) that is comparable to EV. Post-2010, but prior to the pandemic, EBITDA has been bouncing around the $450M mark and FCF has averaged ~$225M. Dividing the $1.93B EV by $225M gives the 8.5x multiple I alluded to in the summary.

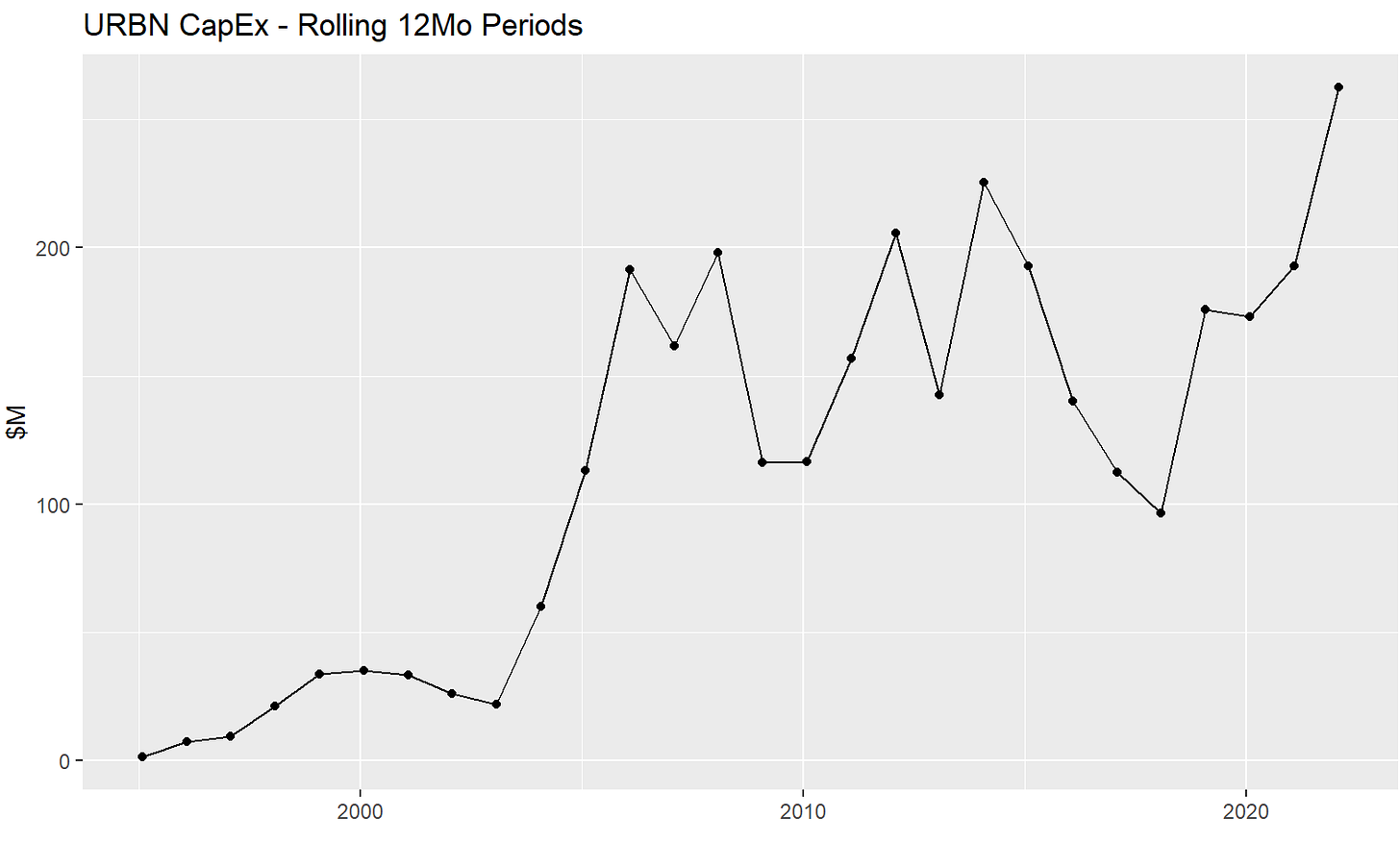

One note on capex. The company has spent significantly more over the last 12mo as a result of its buildout of a Kansas City fulfillment center to support ecommerce growth:

Once this construction is over, I expect capex to revert to pre-pandemic levels supporting a return to $225M+ of FCF. At the recent GS Retail Conference, the CFO noted: “those two big projects back-to-back have elevated our overall capital number to be over 200M over the last two years. You should start seeing that come down next year to be in the mid 100s or so….low 100s in the following year”.

P/B & Real Estate Portfolio

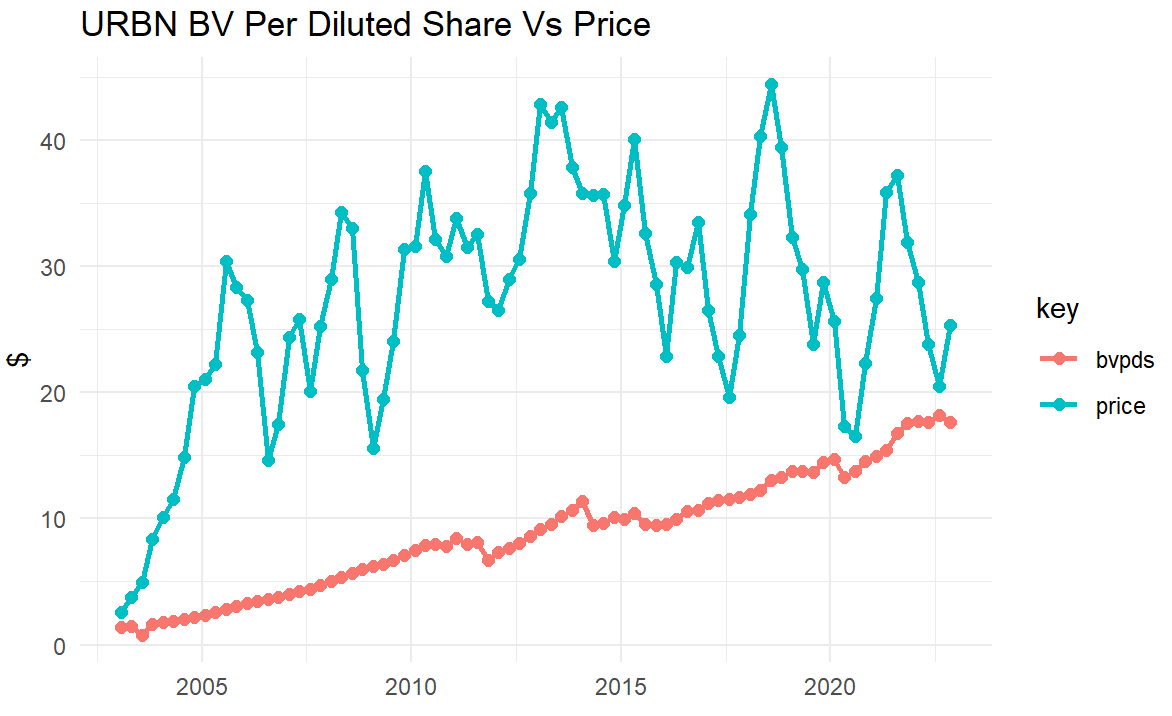

Before getting into the real estate holdings, here is an interesting chart comparing URBN tangible book value to share price over time:

Despite fairly persistent growth in tangible book per diluted share, the price/book ratio is quite narrow relative to history. Much of that book-value-per-share growth has come from repurchases, while the rest is due to growth in PP&E in the past and growth in current assets more recently.

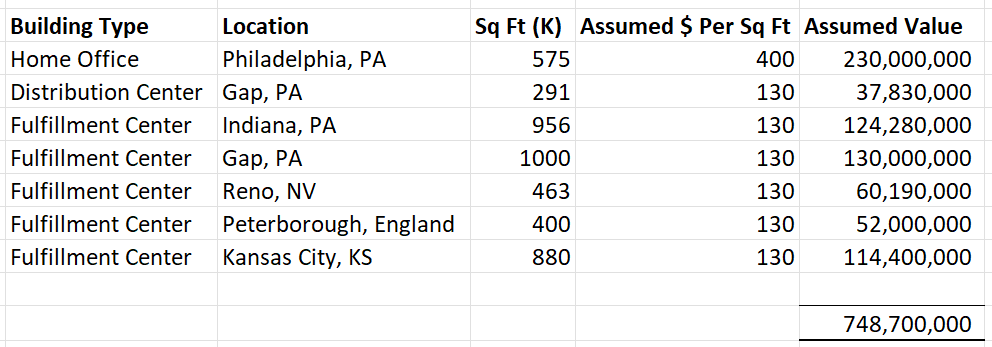

Turning to the real estate portfolio, here is the breakdown per the most recent 10K with my valuation assumptions:

I assumed $400/sf for the HQ office space (based on a google search) and $130/sf for the distribution/fulfillment space (which I got by looking at industrial REIT comps like $PLD). I am not a real estate investor, so take this analysis with a large grain of salt. At this assumed valuation, real estate is ~40% of URBN’s enterprise value, providing significant protection in worst-case future scenarios. I believe the use of sale-leasebacks on this real estate portfolio at some later point could unlock significant value, but I haven’t seen an indication this is on management’s radar at present.

Brand Mix

URBN is primarily composed of three brands: core Urban Outfitters (UO), Anthropologie (Anthro) and Free People (FP). UO is the original brand, and is in a mostly mature state. Anthro and FP are newer with room to grow. FP in particular is the fastest growing and ostensibly highest margin brand.

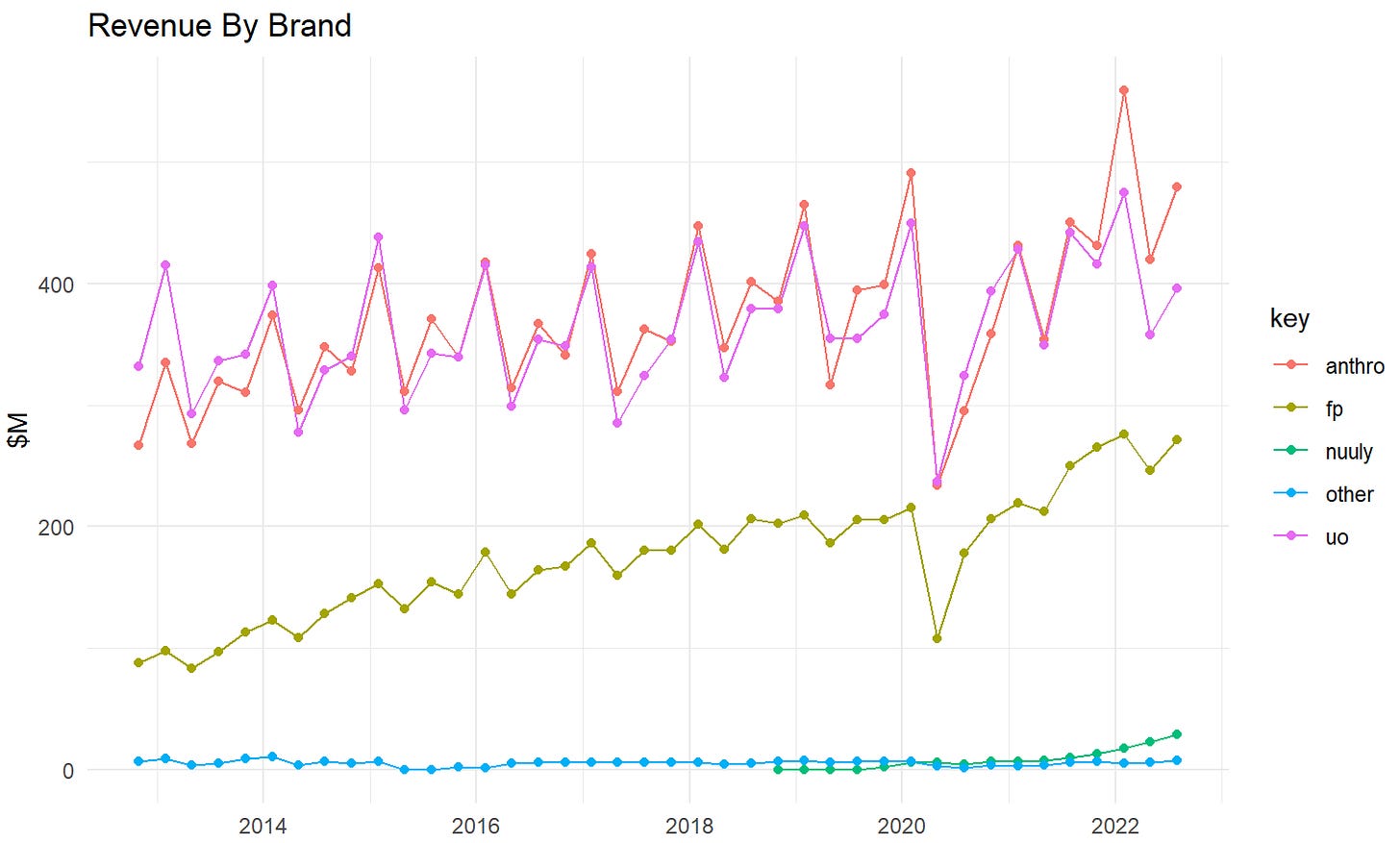

The company doesn’t provide much profitability info by brand but does provide revenue details:

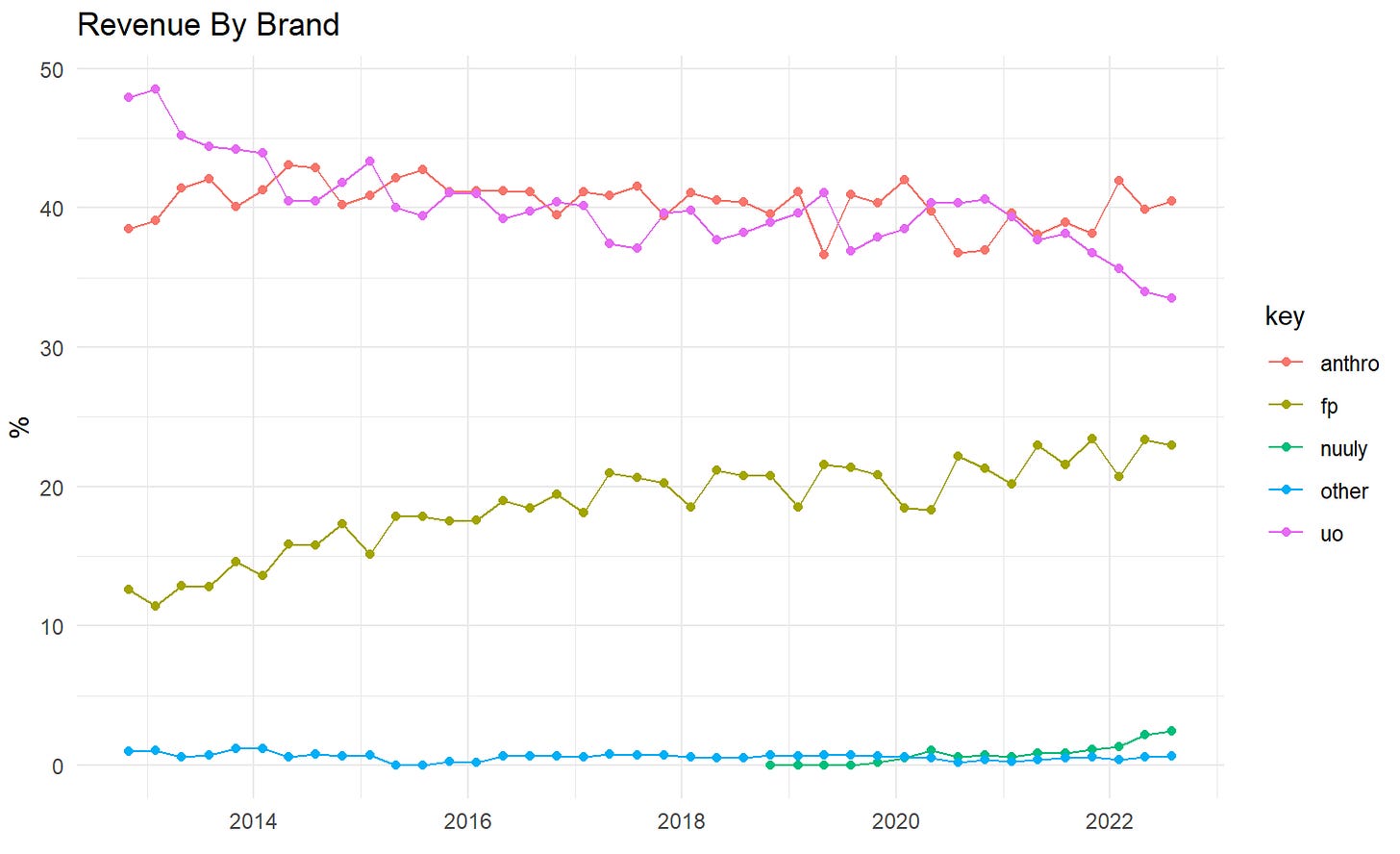

And here is percent of revenue by brand:

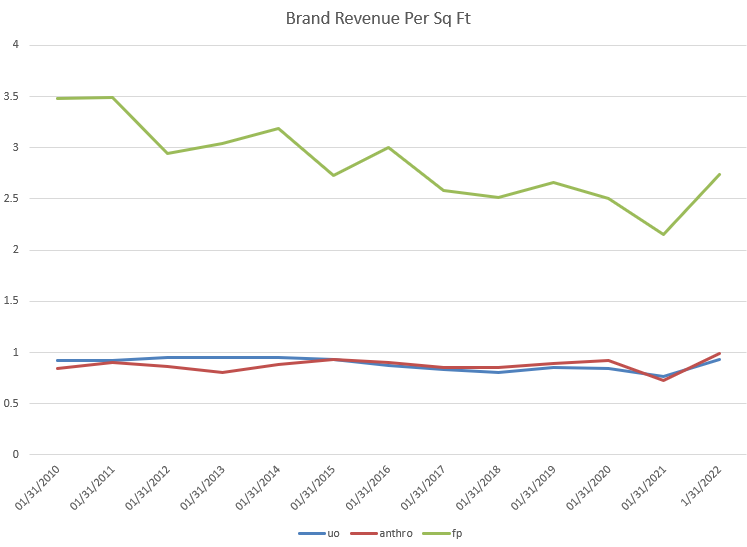

UO has been steadily losing share to the faster growing FP brand. In addition to being faster growing, there is reason to believe FP is higher margin. I have been unable to find a direct disclosure on profitability, but here is revenue per square foot of retail space to give a sense of operating leverage:

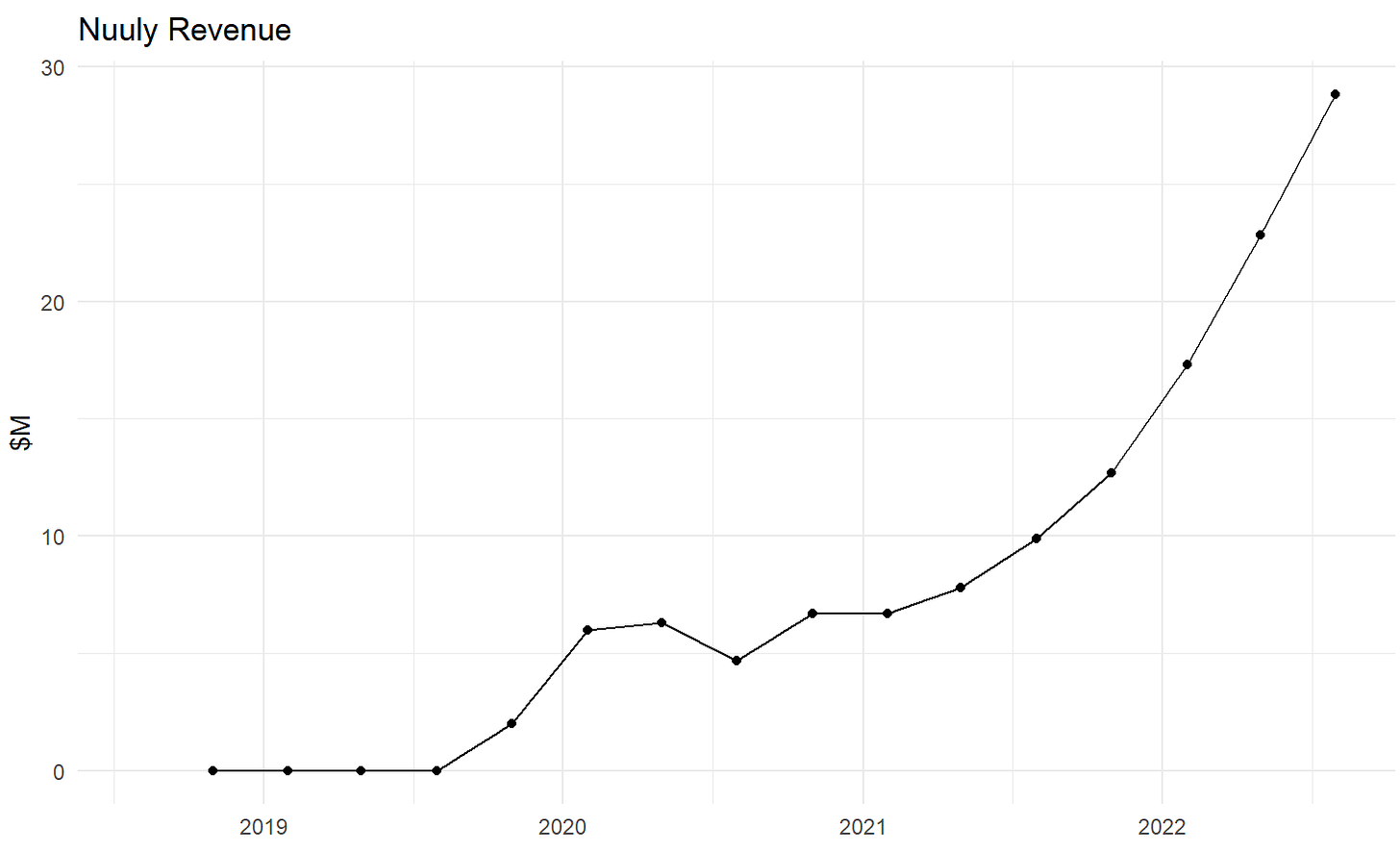

Nuuly is an interesting new online-only brand in the mold of “Rent The Runway” that is off to some early momentum despite a difficult environment. The brand is not significant to the stock now but may be additive in the future:

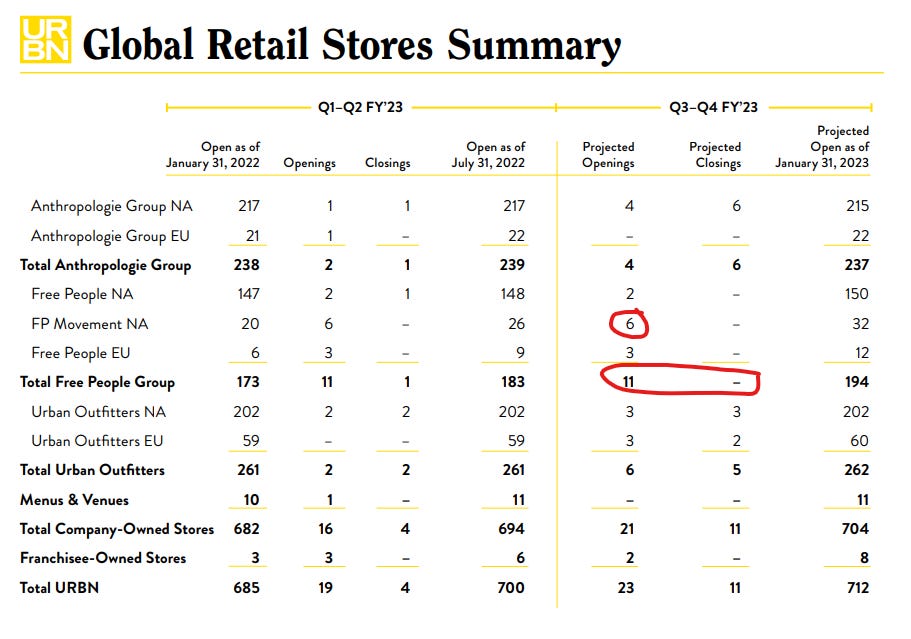

Free People “Movement” is another sub-brand worth mentioning given the recent success of premium athleisure (Lululemon). The company is seeing traction with this concept, and Movement stores are a capex priority:

Industry Headwinds

The apparel industry as a whole has been on a rollercoaster since the COVID outbreak. In the early days of the pandemic, the industry suffered as social events were cancelled and consumers tightened their wallets. The paradigm shifted in early 2021, as Delta faded just in time for helicopter stimulus checks. Consumers hadn’t spent much on clothes over the past year, had money in their wallets from stimulus, and social calendars rapidly filled up as reopening commenced. Apparel predictably did exceptionally well, with surging demand and record low markdown rates. The industry responded by ramping up production, which contributed to the surging labor, transport and raw materials costs that defined 2021. The paradigm began to shift again as we moved into 2022. Consumers had just spent a bunch of money on apparel and could afford to wait a bit before buying more. Surging production met lower demand at the same time as elevated COGS (related to raw materials prices and high transport costs) further compressed margin. This has led to ongoing earnings pressure which has deflated stock prices.

While things are not great in apparel at present, I think it is fairly safe to assume that the industry is not structurally worse off than it was before the pandemic gyrations. We are in the 7th or 8th inning of a classic inventory cycle - it will be painful to work down inventory, but once things stabilize there is no reason margins can’t return to normal. I’m not sure whether this process will take 2, 4 or 6 quarters to complete, but I know stock prices will move before the bottom is obvious. Raw material and transportation prices have almost fully normalized, which should feed through in COGS in Q4 and early 2023.

URBN has two advantages (in addition to the under-levered balance sheet) that should ease the pain over the next few quarters relative to certain other apparel retailers. First, two of the three brands cater to higher income customers (Anthro and FP). Higher-end apparel has been somewhat insulated from pandemic gyrations as affluent customers were less impacted by stimulus checks in 2021, and are less pinched by inflation in 2022. Anthro and FP, which now represent ~60% of revenue, should buffer the extent of the drawdown in earnings. Second, the company has a good e-commerce mix relative to many peers. To the extent the pandemic accelerated the shift to online shopping, URBN has a good physical/online blend and shouldn’t lose share. Morgan Stanley notes that the company was able to do 64% of sales online in 2020.

Concluding Thoughts

I purchased URBN prior to the recent runup in prices, but I still think it offers compelling value today. The market trades the name like a levered cyclical, which is inconsistent with the company’s large real estate holdings, net-cash position and large proportion of higher-income customers. The CEO, Dick Hayne, seems to have a real knack for creating successful apparel brands, which brightens the prospects of emerging concepts like Nuuly and FP “Movement”. The next few quarters will continue to be messy, but an eventual return to $225M+ of FCF seems very likely in my view.