Investment Summary

Magnera is a global (50% North America/33% Europe), white label manufacturer of “non-woven” paper products. This means they convert wood pulp and polypropylene into a variety of items such as diapers, wipes, home wrap and tea bags. They then sell these items to consumer product companies, such as Proctor and Gamble, who sell them to consumers under well-known brands such as Pampers. The company operates in a cyclical and competitive industry, which is currently suffering from over-supply thanks to a large ramp in capacity during the COVID boom years. There is substantial reason to believe we are approaching a bottom, however, and any recovery in margins/revenues, when paired with the considerable financial leverage, could lead to a smash success story for the shares (~$70/sh). In my view, the stock has room to appreciate into the $30s just from stabilization at current earnings levels.

Industry Overview & Corporate History

The non-woven industry has some positive attributes, but is overall a fairly difficult place to compete. On the positive side, the industry benefits from secular growth in demand as rising global wealth increases demand for consumer products like disposable diapers.

A growing end-market is a huge plus which eases competitive tensions that might otherwise boil over in a shrinking market. On the negative side, while there are certainly some switching costs for consumer product group (CPG) buyers, these are on the whole manageable, and so Magnera has little in the way of durable pricing power and is largely at the mercy of industry-wide dynamics. Magnera lays claim to being the largest player in their specialty materials markets, and calls out particular dominance in a few categories like absorbent hygiene products (Pampers/Huggies), cleaning wipes (Clorox/Lysol), healthcare apparel (scrubs/masks), food & beverage products (tea bags), dryer sheets (Bounce) and home wraps (Typar). It is always nice to be the most scaled player in an industry like this, but overall the non-woven space is fragmented with no player holding an unassailable position.

Magnera was formed only a couple months ago, and is the product of a merger between Glatfelter Corporation, a non-woven player struggling under a heavy debt load thanks to some ill-timed acquisitions at near the peak of the COVID boom, and the non-woven division spun out of Berry Global Group. The merger was a lifesaver for Glatfelter, which seemed on its way to bankruptcy barring a rapid recovery in industry conditions. Given that Berry very rapidly entered into a merger with Amcor (another packaging player) following the spin, it seems most plausible that the spin of its non-woven division (and the later sale of its tapes business) had to do with cleaning up non-core businesses on the eve of combining with Amcor to form a pure-play packaging business. Because Magnera is a small SpinCo operating in what has been a troubled industry, there has been selling pressure from index and other players which creates an elevated potential for mispricing.

Margins & Valuation

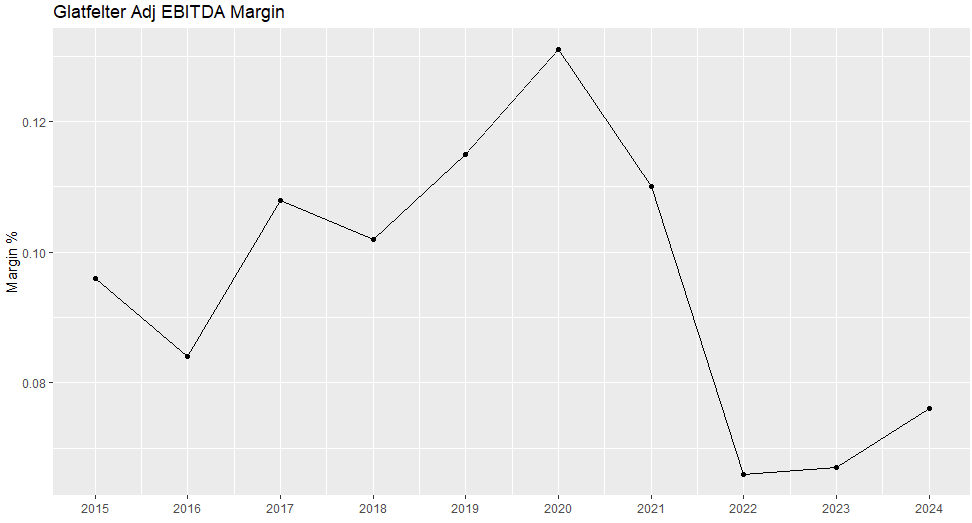

The most important thing to understand about Magnera is the current industry margin backdrop. I focus on margins as there are significant acquisitions/re-categorizations that make revenue numbers hard to follow when looking at history. Here are the margin profiles for the two legacy components:

Note that, for Glatfelter, I use margins adjusted for the disposition of the specialty paper division in 2018 which weighed on the margin profile. There is also a bit of changes year to year in what Glatfelter reported as its adjusted EBITDA for a given historical year, but switching the number used doesn’t change the story significantly.

To summarize these charts, we had pre-COVID margins which were generally expanding for GLT and contracting for Berry, then a surge in margins (and sales) during 2020 and 2021 reflecting exposure to wipes/personal protective equipment and general shortages in those years, and finally a collapse in margins in 2022 as supply constraints led to capacity investment and inventory hoarding which left the industry oversupplied as demand pulled back. European operations were further impacted by the Ukraine war as Europe was net supplier of non-wovens to Russia. Since 2022 margins have bottomed out, and even show signs of inflection for Glatfelter. This is despite sales continuing to decline a bit as demand returns to pre-COVID norms.

This is a fairly standard COVID cycle, and my inclination is that margins will recover once underlying end-market growth fills in excess capacity. In fact, it would not be shocking to see a bit of an over-reaction in margins as capacity investment has been shut off the last few years while in the meantime cost structures have been optimized. The fact that margins are no longer moving lower hints to me that the path has been cleared for expansion to begin.

I value Magnera using a weighted average of three scenarios.

Scenario 1: Stagnant Margins (42.5% weight)

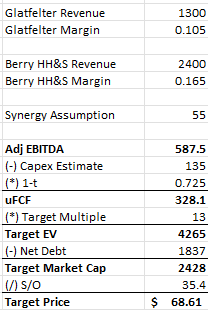

In this scenario I assume that margins are done declining, but upward inflection doesn’t occur. This implies a permanent loss of competitive edge relative to the pre-COVID years, and would likely be due to a competitive advantage gained by some other domestic or overseas competitor. The possibility that lower-cost overseas competitors (Magnera’s manufacturing base is concentrated in North America and Europe) have taken share and driven down margins would be particularly concerning if not for the impending rise of tariffs in the US under Trump (and probably in Europe as well to a lesser degree). Assuming trailing-12-mo margins and revenue, and assuming management delivers on their synergy expectation of $55M (repeatedly referenced in the slide deck and in the M&A call as conservative) and using a normalized capex number (early capex spend will be lower as the company de-levers from 4x→3x) I get the following:

Scenario 2: Margin Normalization (42.5% weight)

Here I assume margins normalize towards pre-COVID levels over time. I use 16.5% margins for Berry and 10.5% for Glatfelter. This drives a large increase in target price thanks to the leverage:

Scenario 3: Continued Decline (15% weight)

In this scenario I assume that competitive intensity drives margins even lower, disproving my “trough margin” theory. Given the leverage, this is a very bad, if in my opinion unlikely, scenario for the shares. Even a 30% decline in margin levels from here would render the company worth little more than its debt. I assume a token $5 in this scenario.

Putting this all together I get a .425*$35 + .425*$69 + .15*$5 = $45 price target once the dust settles. I am therefore bullish on the shares and think there is a high probability we see a significant repricing after a year or so after technical selling has cleared and financials have been printed and proved out.

Finally, I will leave you with a rough sketch of cash flows based on their capex/EBITDA guidance over the next few years. This assumes a $19 share price and that all cashflows are paid out as dividends:

Thanks for the post! Really nice company that would be seen obsolete by quick look but the non woven industry is really good cashflow after the dust is going to settle down. Bought today at $12.. Do you know by chance why the depreciation is so high in contrast to capex?